Why the Financial Industry Requires Standardization for Digital Assets

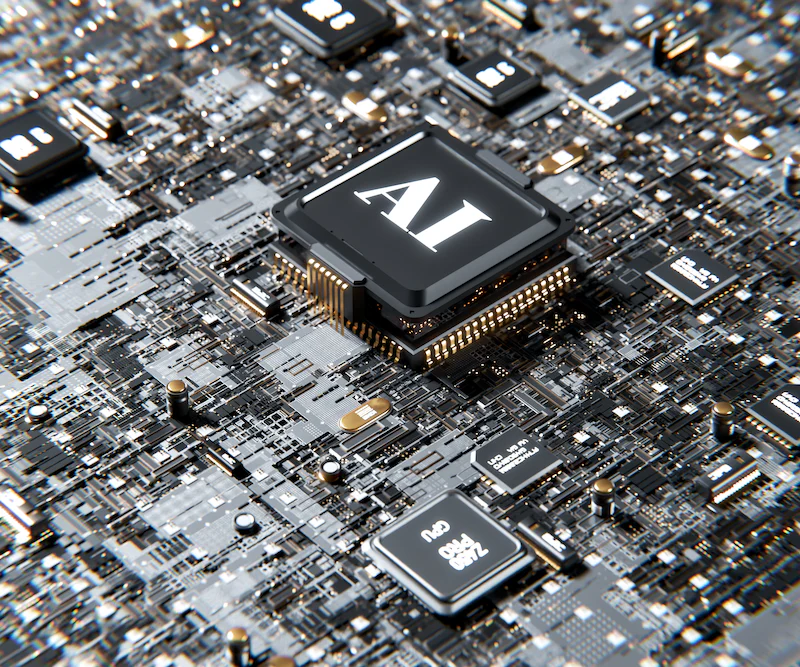

As the financial industry progresses into the era of decentralized finance (DeFi) and digital assets, such as crypto-assets and tokenized securities, the absence of comparable standards has emerged as a significant challenge. While these assets offer transformative benefits, including greater accessibility, programmability, and efficiency in issuance and handling, their fragmented information landscape threatens to impede their adoption and integration into the broader financial ecosystem. To achieve mainstream acceptance, digital assets must learn from traditional markets. Just as established financial data standards—such as ISINs for securities or GAAP for accounting—have been crucial in fostering trust and facilitating growth, digital assets require their own set of global standards.

Dr. Cam-Duc Au

Dozent bei FOM Hochschule für Oekonomie & Management