1. Current market situation

Status Quo: Digital Euro

A current ECB study states that cashless payments (e.g. using EC or credit cards) within the EU are gaining further popularity. The proportion of cash payments in all transactions fell to 59 % in 2022 (comparison 2019: 72 %). Only 30 % of German consumers see cash payment as a preferred payment option (Handelsblatt, 2022). Digital payments are proven to be increasingly popular (ECB, 2023).

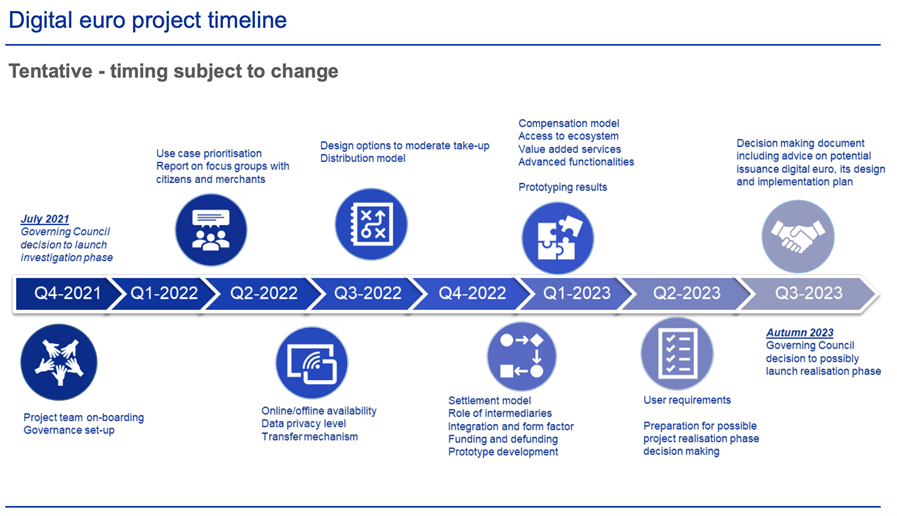

The introduction of a digital euro as a so-called retail CBDC, which is directly accessible to everyone (e.g. natural persons, companies), intends to pay justice to the digital trend. Another so-called Wholesale CBDC “only” intends to cover the payment currents between banks/financial institutions in the interbank business. In July 2021, the ECB announced the beginning of the two-year examination phase. The examination is based on a collaborative approach with stakeholders from the market, among other things, via the Euro Retail Payments Board (ERPB) and the digital euro Market Advisory Group (MAG). The analysis will end in autumn this year and the ECB council will decide on a possible transition to the implementation phase (see also the following illustration/roadmap). A possible public introduction of the digital euro in 2026 is sought.

Source: ECB, 2022

The following essential decisions or insights of the Governing Council on the examination phase of the possible „design“ of the digital euro are currently available and are stated in the following:

- Complementarity: The digital euro will act as a supplement to cash and thus only be used for payment transactions (unequal Bitcoin as „Store of Value“ or „Digital Gold“). A „hoarding“ could be documented with negative interest. A relay interest model is currently being examined.

- Limitation: To prevent Bank Runs and the Disintermediation of the banks, the digital Euro should be limited to up to 3000 euros per consumer (final decision remains to be seen). With around 340 million people in the euro area, analyst estimates would result in an indicative inventory of 1.5 trillion digital euros (techbook, 2022).

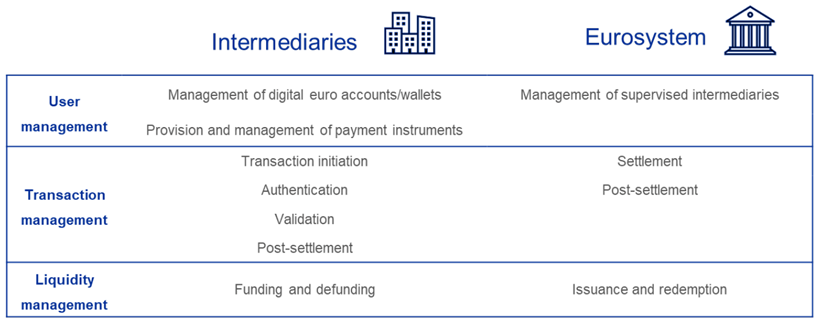

- Ecosystem of intermediaries: The ECB follows the principle of subsidiarity and provides so-called „supervised intermediaries“ as a significant success factor for the introduction. Exemplary tasks such as the Wallet provision, KYC/AML and other service/product developments are handed over to intermediaries. For a controlled development of the ecosystem, the ECB has launched the digital euro Scheme Rulebook Development Group to develop a common Pan-European framework/scheme. The publication of the digital euro and the settlement remains under ECB sovereignty:

Source: ECB, 2022

- Offline payments: There is consensus that payments must work independently of internet availability. This is to be ensured by intermediaries, however there are still no concrete solutions in the media available.

Current global CBDC developments and pilot projects

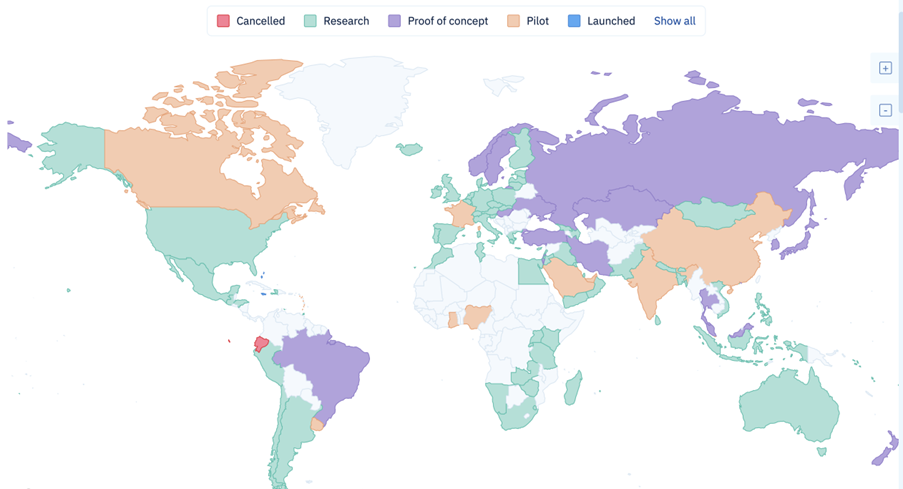

The topic of CBDC has already been well received by governments and central banks worldwide. 85 % of the central banks are currently in an investigation phase (IMF, 2022). So far there are only the following two launched CBDCs: the Sand Dollar (Bahamas) and the Jam-Dex (Jamaica). Other global pioneers include China (E-Cny) and Sweden (e-crown), which are already in the test phase of their digital currencies.

China has been researching a CBDC for many years and has been in the practical test phase since 2021. Large events such as the 2022 Winter Olympics were used strategically to advertise the Yuan wallet and enable payments with selected dealers. Government officers were partially paid in digital Yuan. In 2021, more than 200 million users registered for the E-Yuan, thereby leading to a transaction volume of the equivalent of around 12 billion euros since the pilot was launched (CoinTelegraph, 2021). Nevertheless, the adoption or true use of the E-Yuan remains low, which is why China is currently „giving away“ about $ 30 million in the form of subsidies and vouchers to promote the CBDC (BTC-Echo, 2023).

Within the EU, the Swedish Riksbank is considered a pioneer in CBDC. The Swedish central bank has been researching a possible introduction of the e-krona since 2016. The test phase ended in 2022 and the effects on the economy and the requirements for legislation are currently being analyzed (Riksbank, 2023).

A noteworthy global CBDC pilot project is currently taking place in the United States, where the American central bank (FED) works in a cooperation with 12 global financial companies (e.g. HSBC, Wells Fargo, BIS) on a pilot project for the digital US dollar (BTC-ECHO, 2022). Another example is the central bank of Montenegro, which collaborates with the blockchain Ripple to develop a digital currency (CoinTelegraph, 2023).

Other advanced countries such as Australia, Estonia, France and Thailand are currently developing plans for a digital central bank currency based on the Ethereum blockchain. In the following illustration, the rain of global activities regarding the development of CBDCs can be seen, which underlines the relevance of the digital currency:

Source: CBDCTracker.org, 2023

Open questions and challenges

Focusing on Europe and the closer decision of the ECB Council in Q3 2023, there is still a variety of open questions about the design of the digital euro in the media. In addition, the most relevant questions/challenges are still under discussion.

To date, it is still not known what technological base will be utilized to implement the digital euro. Is it based on the distributed ledger technology (DLT) or will there be a hybrid variant with a non-DLT solution?

The publications of the ECB also speak of „supervised intermediaries“, which are supposed to create an ecosystem for the CBDC. However, it has not yet been revealed to what extent these market players are regulated and which specific requirements have to be met for this kind of business. The question is of particular relevance in order to enable the evaluation of the business attractiveness from an entrepreneurial perspective. Because regulation always goes hand in hand with increased costs, business cases must be carefully calculated to identify economic potentials.

2. Critical reflection

In the current literary debate, the advantages and disadvantages of CBDCs are still discussed controversially (BTC-ECHO, 2023; Die Bank, 2023). Basically, one can distinguish between the two parties of the (i) crypto industry (e.g. „Bitcoin disciples“, crypto fintechs) and (ii) the representatives from public authorities and research institutions (e.g. ECB, Bundesbank, BIS).

Benefits of the Retail CDBC / the digital Euro

From the public authority’s point of view there are a variety of potential advantages associated with the introduction of the digital euro.

On the one hand, the legal validity of the digital euro is guaranteed by the ECB, which is exactly in contrast to private stablecoins. This should give users more security in daily payment use and also guarantee a 1:1 value replication of the euro. On the other hand, the CBDC should be recognized for payments in the countries of the euro zone, which creates convenience in cross-border use. In addition to the aspect of user-friendliness, the introduction is intended to inspire the creation of a uniform European payment system (á la epi European Payment Initiative). This poses a variety of advantages for the governments/central banks. Above all, every transaction in the Central Bank database can be traced, which means that e.g. tax avoidance is almost impossible, thereby leading to higher tax revenues. This also implies that money laundering/AML and other criminal activities can be better combated in justified suspected cases.

From the crypto industry’s point of view, the main advantage is that the future use of full-digital services and products of public institutions can be more convenient. This can be attributed to a digital end-to-end capability. Efficient digital processes, which are using smart contracts and the programmability of the digital euro (e.g. applying for ID card, driver’s license), can be offered to the citizens at lower costs.

Drawbacks of the Retail CDBC / the digital Euro

From the crypto industry’s point of view, there are certain caveats that are still subject of controversial discussions. The most common disadvantage is the task of anonymity compared to cash payments because every CBDC payment reveals the full identity of the user. This is contrary to the original beginnings of the crypto community, where transactions can be made, at least in a pseudonymous manner. Furthermore, the possible direct influence of governments/central banks is criticized. By potentially analyzing and systematically controlling the purchase behavior of users (e.g. through the exclusion of certain dealers, products, services), a CBDC would endanger the free markets. Besides, there is concern that the digital euro can be increased digitally, which would promote the excessive present monetary expansion even more and further weaken the users purchasing power (e.g. by means of money/inflation, cold progression). The “Cantillon effect” is often referenced by crypto enthusiasts (Frankfurter Rundschau, 2020).

3. Conclusion and outlook

The bottom line is that CBDCs have a right to exist as a supplement to classic means of payment and are therefore used globally (DEA, 2023). This is not just a purely technological, but above all a political and social matter that speaks for the implementation of the digital euro (IT-Finanzmagazin, 2023). However, many questions about the design of the digital euro remain unanswered, above all the technological basis and a strategic plan for a successful. Although reference projects in other countries have several years ahead of research and development have, so far none of them achieved adequate adoption. Also, the establishment of a European ecosystem of intermediates requires time and capital to provide users with a corresponding CBDC offer.

In the outlook, the digital euro must progress much faster to keep pace in competition with the rapidly growing crypto industry because the development of layer-2 scaling solutions or the further establishment of stablecoins are constituting serious payment alternatives for CBDCs.

Um einen Kommentar zu hinterlassen müssen sie Autor sein, oder mit Ihrem LinkedIn Account eingeloggt sein.