Introduction – New Ways of Budgeting

Organizations in the early 21st-century face challenging market dynamics and constant change driven by disruptive innovations, such as the Internet of Things (IoT), Internet of Services (IoS), Big-Data-Analytics (BDA), or artificial intelligence (AI). These innovations also affect the way of corporate budgeting, therefore discourses on budgeting effectiveness gain contemporary importance for practitioners and researchers. Organizations are dared to ensure solution-oriented budgeting approaches to solve budgeting obstacles, such as the killing of managers’ motivation and innovative strength while also ensuring agility and pinpoint accuracy in attaining corporate objectives.

In this context, the given article describes the opportunities and challenges of artificial intelligence (AI) in the context of corporate budgeting. The question of interest is stated as follows:

“How and to which extent does AI offer opportunities to improve existing budgeting approaches?”

This article is a result of literature studies in which other authors’ perspectives and critical analyses on budgeting approaches have been used and combined with the latest research on AI in corporate budgeting.

This article is divided into four sections with respective sub-chapters. The initial introduction covers the research problem, objective, and scope. Subsequently, Chapter 2 offers an introduction to the basic understanding of AI and budgeting. Furthermore, the well-known budgeting approaches and their weaknesses are briefly presented. In Chapter 3 opportunities of AI in budgeting are outlined and newly arising challenges of an AI-based budgeting approach are discussed. Chapter 4 provides a short conclusion and recommendation for future research.

Artificial Intelligence & Budgeting

According to Jiang and Neapolitan, the computer scientist John McCarthy coined the term “Artificial Intelligence” in a workshop about neural networks and intelligent systems at Dartmouth University in 1956. The objective of this new research field was to create computer systems that could learn, react, and make decisions in a complex, changing environment (see Neapolitan & Jiang, 2018, p. 4). In fact, the first AI program was already being developed at this time by Allen Newell and Herbert Simon, called the “Logic Theorist,” which aimed to mimic the problem-solving skills of a human being. It was able to prove 38 of the first 52 theorems in Whitehead and Russell’s Principia Mathematica (McCorduck, 2004 in Neapolitan & Jiang, 2018, p. 4).

Nowadays most definitions of AI cover the idea of enabling machines to perform tasks that initially required human thinking abilities such as learning, decision making, and problem-solving (see Pennachin & Goertzel, 2007, p. 1; Arel et al, 2010, p. 13; Kaplan & Haenlein, 2019, p. 1). In case of creating programs that demonstrate intelligence in a specialized area, AI-methods are referred to as narrow AI solutions (Pennachin & Goertzel, 2007, p. 1). El Misilmani and Naous summarize in simple terms: “AI is implementing human thinking ability in machines” (El Misilmani & Naous, 2019, p. 1).

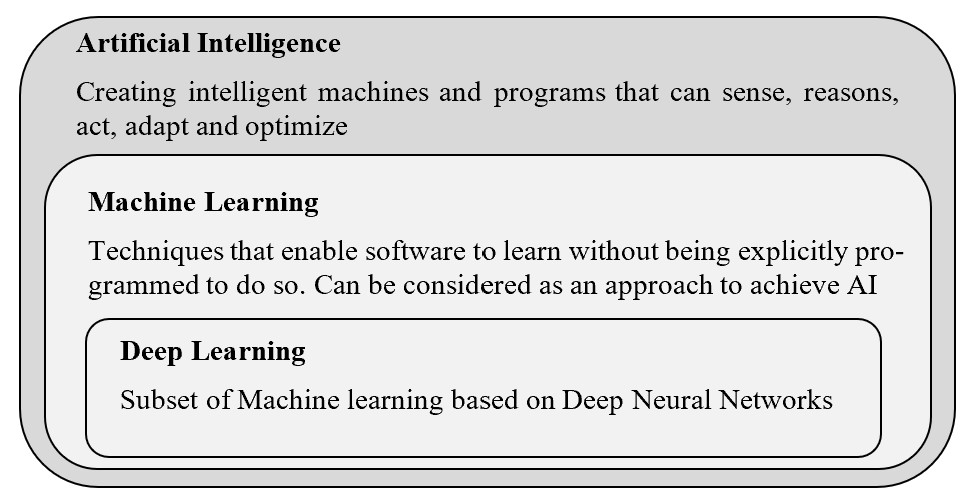

A major subset of AI is called Machine Learning (ML). These terms are often even used interchangeably. Nevertheless, ML should be rather understood as an enabler for AI applications (Zhongzhi, 2019 p. v). ML covers a large family of techniques used for sophisticated new forms of data analysis that are becoming key tools of prediction and decision-making (Lehr & Ohm, 2017, p. 655). In short, ML is based on algorithms that can learn from data without relying on rules-based programming. These algorithms can be very powerful, but their success relies on the condition and size of the data collected (see Gartner, 201, 2-4). Therefore, this discipline is frequently associated with statistics and data analysis (El Misilmani & Naous, 2019, p. 1).

The following figure illustrates the conceptual understanding of AI and its subsets.

Already today AI, or rather narrow AI, is an important part of our daily lives. It seamlessly performs human functions in a narrow scope, such as speech processing (Siri, Alexa) and image recognition (Google, Facebook, Instagram, navigation-systems). In the future, AI is expected to affect most of our daily activities with fundamental changes and a tremendous impact on society (see Bundy, 2017, p. 285 et seq.; Kaplan & Haenlein, 2019, p. 1 et seqq.).

Status-Quo Review on Budgeting Approaches

-History & Functions of Budgets –

The first records of budgeting practices can be traced back at least to the 1920s when large industrial organizations introduced the formal use of calculation tools to manage cash flows and costs (see Hope & Fraser, 2003, p. 3; Jäger & Altrogge, 2011, p. 1). The understanding of budgeting evolved with time, and during the 1960s budgets were also used for incentive systems to drive and evaluate management performance (Goode & Malik, 2011, p. 208; Jäger & Altrogge, 2011, p. 1). Today, budgeting is universally performed and a standard tool in organizations given its importance to monitor and maximize value. Various researchers describe the budgeting process as a cornerstone of management control (see Parker & Lewis, 1995, pp. 212-213; Eckholm & Wallin, 2000, pp. 520-521; Hansen et al., 2003, p. 95; Libby and Lindsay, 2010, p. 56). Johansson and Kullven argue that there is no general definition of what a budget means to an organization, but its meaning is specific to each organization (Johansson & Kullven cited in Asowga & Etim, 2017, p. 1).

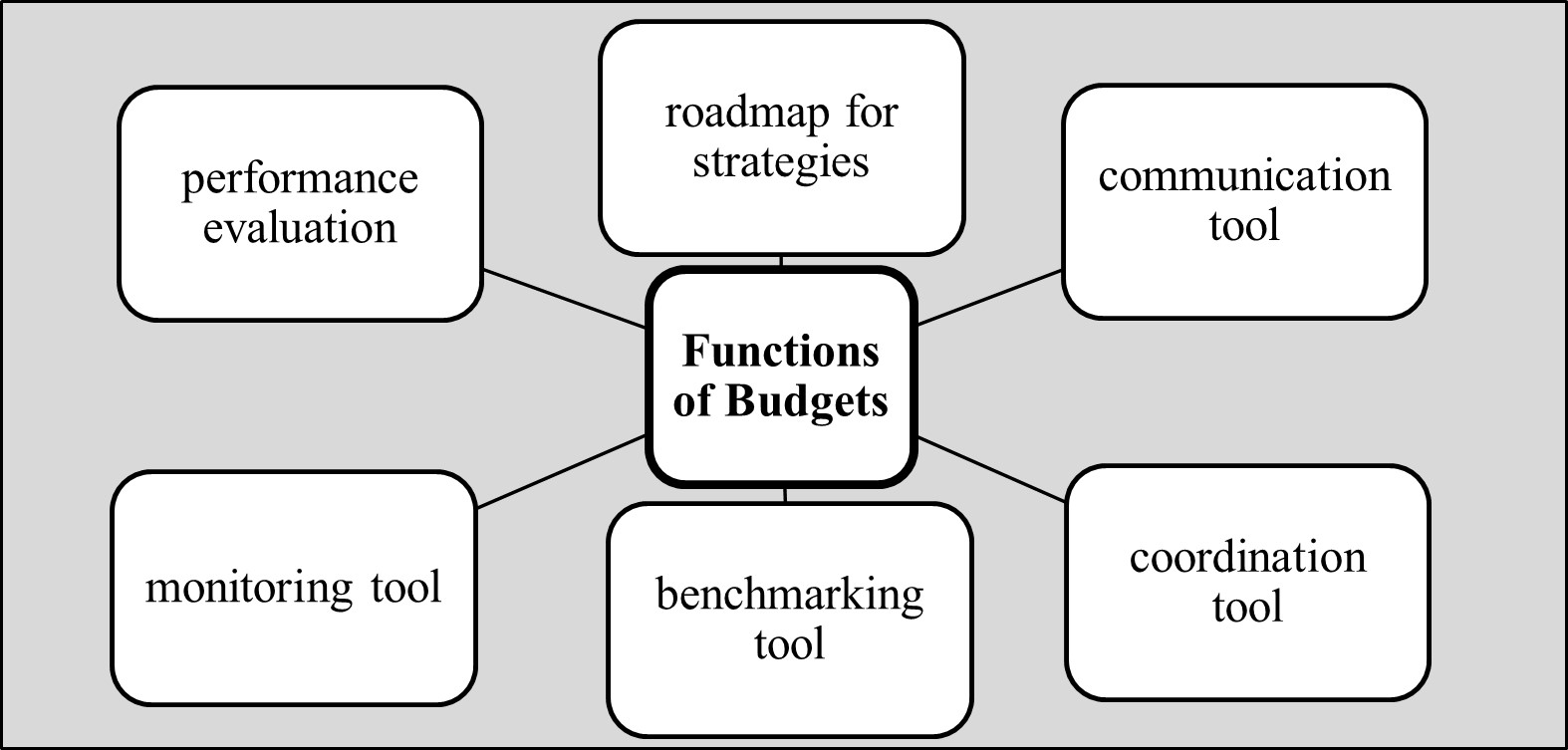

The most important functions of budgets can be summarized as follows:

In practice, different budgeting approaches have been conceptualized. The approaches and their weaknesses are briefly presented in the following.

Budgeting Approaches

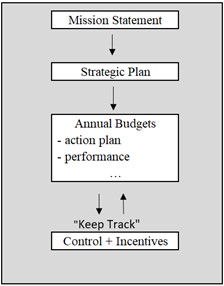

Traditional budgeting is oftentimes described as a form of fixed, annual budgeting exercise (Hope & Fraser, 2003, p. 3; Jäger & Altrogge, 2011, p. 1). Hope and Fraser refer to the traditional budgeting system as a „command and control model,” while decisions, resources, and rewards flow down, information flows back up. The model is characterized by a strict hierarchy where the lower-level management is compelled to obey the guidelines and achieve objectives of the senior-level management (Hope & Fraser, 2013, p. 71). The following figure illustrates the traditional understanding of budgeting according to Hope and Fraser.

Since the 1990s the traditional model is being criticized for not adapting to contemporary needs (see Bunce et al., 1995; Wallander, 1999; Jensen, 2003; Player, 2003; Hope & Fraser 2003). Morlidge and Player criticize that many budgeting rules were developed 100 years ago, and therefore require a facelift (Morlidge & Player, 2010 cited in Zeller & Metzger p. 393). The arguments in favor of a “facelift” are based on the changing environment driven by globalization, shorter product life-cycles, advanced technologies, and sophisticated customers, which are said to require more agility and room for creativity (see Bunce et al., 1995, p. 254; Fanning, 1998, p. 4; Hope & Fraser, 2003, pp. 2-3).

As a consequence of the described limitations, alternative approaches have been developed and debated by academics and practitioners. The main alternatives are called Beyond Budgeting and Better Budgeting (Bunce et al., 1995, p. 253; Jäger & Altrogge, 2011, pp. 1-2).

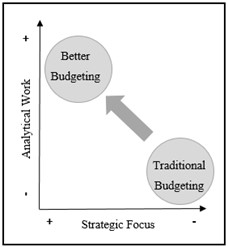

The Better-Budgeting approach still retains the budget. However, the emphasis of budgets is on more analytical, value-based contents by also taking non-financial key indicators into consideration (Horvàth 2009, p. 218; Jäger & Altrogge, 2011, pp. 2-3).

The illustration below explains the core idea of Better-Budgeting.

In short, RFs create frequent budgets to provide more accurate forecasts. ABB puts emphasis on the identification of value-adding activities. ZBB demands managers to justify budgets every year to close information gaps and prevent dysfunctional behavior. VBM encourages a focus on creating shareholder value with consideration of strategic objectives while evaluating the strategic purpose of projects, and finally, profit methods consider short- and long-term objectives whilst ensuring sufficient cash is generated (Neely et al. 2003, p. 22 et seqq.; Goode & Malik, 2011, p. 212).

Neely et al. describe different techniques to overcome the flaws of the traditional approach such as Rolling Budgets/Rolling Forecasts (RF), Activity-Based Budgeting (ABB), Zero-Based Budgeting (ZBB), Value-Based Management (VBM), or Profit Planning (Neely et al., 2003, 22 et seqq.).

On the other hand, a major drawback associated with these techniques is the tremendous time exposure which is said to drive dissatisfaction and lack reactivity (Goode & Malik, 2011, p. 208; Reinke 2016, p. 53).

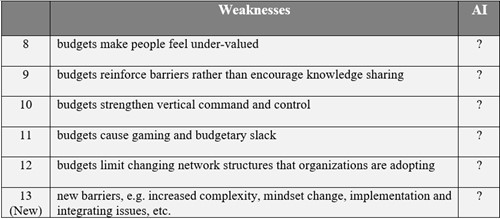

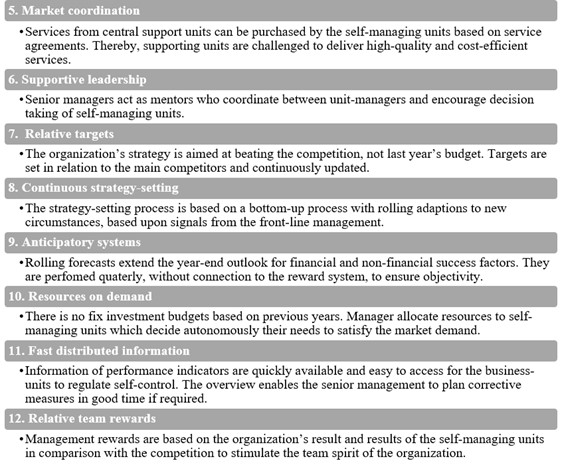

Beyond Budgeting meanwhile intends to replace budgets by a range of new principles (see enclosed: Table 3). These have been suggested in 1998 by the Beyond Budgeting Roundtable (BBRT) with Jeremy Hope and Robin Fraser as its main advocates (Sandalgaard & Bukh, 2014, p. 412; Jäger & Altrogge, 2011, p. 4). Hope and Fraser describe the main objective of Beyond Budgeting is to abandon traditional budgets along with fix performance contracts in favor of new principles and techniques such as rolling forecasts, balanced scorecards, relative performance evaluations and the creation of empowered teams. These techniques are said to help overcome traditional budgeting problems and make organizations more adaptive and flexible (see Hope & Fraser, 2003, p. 3 et seqq.).

Despite the anticipated advantages of beyond budgeting techniques, there are a number of field studies that document the usefulness and continuous use of budgets (see Popseko et al., 2015; Laitinen et al., 2016; Low & Tan, 2016). Fanning considers the budget as a necessary tool for effective business monitoring. They help to provoke debates and actions to gain real benefit for the business (Fanning, 1998, pp. 4-5).

Given the divergence of opinions on best-practices and the idiosyncratic understanding of budgeting functions, it can only be concluded that there is no single best practice. There are rather a number of good approaches. In the following chapter, a review on AI opportunities in budgeting processes is conducted to identify where to enhance and streamline well-known budgeting processes and to also understand future challenges in budgeting.

Artificial Intelligence in Budgeting – Opportunities & Challenges

– Budgeting Opportunities in the Artificial Intelligence Age –

With reference to Daniel Kahneman, there are two systems that define our thinking. There is the intuitive system, which is characterized as fast, automatic, effortless, implicit, and emotional; and secondly, there is the rational system, which is slow, conscious, effortful, explicit and logical (Kahneman, 2015, p. 2). AI can clearly be assigned to the rational system and may support the creation of rational agents, a “synthetic homo oeconomicus,” as outlined by Parkes and Wellman (see Parkes & Wellman, 2015, p. 267). This prototype of a human agent would, according to a study by Grove et al., be the better decision-maker. Grove and colleagues analyzed the accuracy of human and algorithmic decision making, and the results demonstrate that on average algorithmic prediction was about 10% more accurate than human prediction (see Grove et al., 2000).

In budgeting processes, the allocation of resources is always a decision process, and increased rationality in allocation decisions can likely improve investment returns. AI-based budgeting may offer several opportunities to improve allocation processes. These opportunities will be briefly outlined by referring to some of the basic functions of budgets, which have earlier been identified:

- budgets as a tool for benchmarking

- as a tool for communication

- as a tool for monitoring and performance evaluation

For instance, benchmarking exercises can be facilitated and improved by using text analytics also referred to as “Natural Language Processing” or “Text Mining.” These techniques describe the extraction of information from textual data (Gandomi & Haider, 2015, pp. 137-138). With the use of information extraction (IE), any kind of structured information can be extracted from various sources (Gandomi & Haider, 2015 p. 140). Thereby, the algorithms may help organizations to better identify the expectations and needs of stakeholders to support evidence-based decision making.

In constructed-use cases, companies may use these algorithms to extract structured information on the capital structure of its peers. Based on the information obtained, a comparison can be drawn to understand the ratios and to evaluate the target setting for future decisions. Investor Relations may use text mining to faster process information of analysts’ reports and to thereby react and respond speedier to opinion-makers. This technique can support organizations to convert large volumes of generated texts into meaningful summaries. This may also help marketers and other departments to faster and better summarize their customers’ needs, for instance, through an analysis of social network contents.

In this context, information from social networks can also be used to improve the communication function of budgets. Data visualization uses algorithms to create images from data, thereby humans can understand and respond to that data more effectively. AI can support decision-makers by summarizing networks to uncover behavioral patterns and to define and target key stakeholders. Organizations can then use social network analyses to understand the importance of individual stakeholders and their connection to each other. Thereby opinion leaders can be segmented and targeted. Gandomi and Haider explain that the social influence analysis maximizes full potential in viral marketing (Gandomi & Haider, 2015 p. 140).

A further major opportunity of AI can be anticipated in the identification of cause-and-effect relationships in value chains. Thereby new insights can be identified which may support managers in marketing and finance to better measure the return of investments. As a result, optimized spending patterns can be created, for instance, to realize the ideal number of sales professionals or to identify diminishing marginal utility and to predict purchasing decisions of customers including their influencing factors.

Despite the promising outlook on the opportunities, there are also challenges and limitations of AI in budgeting processes that must be considered. Three major barriers have been described in an article by Gartner as follows: poor quality of data, biases in designing AI models, and staff’s fear of job loss (see Gartner, 2017, p. 1-8). In the following chapter further challenges are analyzed and discussed in more detail.

New Budgeting Approach, Old Challenges?

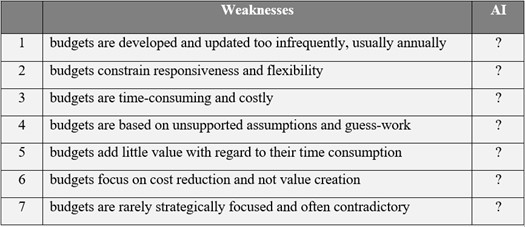

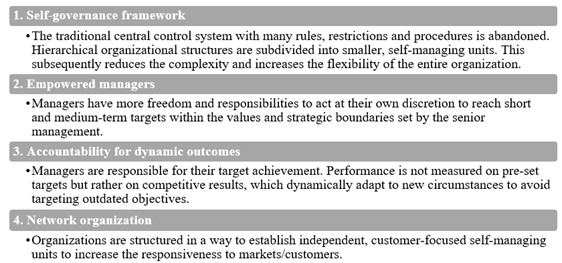

In this chapter, challenges and limitations of AI in the context of budgeting processes are discussed with reference to the reported weaknesses by Neely. The weaknesses summarized are a result of a meta-analysis. They are classified in the following into two superordinate categories in order to structure the analysis of given article and to provide a framework to assess AI solutions in budgeting practices.

Weaknesses one to seven relate to process weaknesses, meanwhile, eight to twelve represent weaknesses driven by soft factors of budgets. As a result of this analysis, an answer is given to the question whether AI is able to solve reported weaknesses of the well-known budgeting approaches.

With reference to the first point mentioned in the table above, it can be expected that the use of AI in budgeting processes offers more frequent updates due to the faster processing of AI in comparison to the conventional budgeting approaches which are driven by human activities. In turn, managers have the opportunity to react faster to changing circumstances through more frequent updates. However, it can be strongly assumed that the development of a budget does not become cheaper despite the automatization of repetitive exercises. Given the fact that a more sophisticated analysis offers more insights, there will be more content to be investigated and consequently, the time used to prepare budgets likely rather increases, which comes along with higher expenses. Presumably, the lacking strategic focus and the guesswork of budgets can be improved given the potential analysis of cause-and-effect relationships. However, there could be a trade-off between an increased responsiveness and flexibility vs. accuracy of data analysis.

This first review on the solution offering of AI in budgeting processes confirms a preliminary conclusion that AI can solve key concerns of the traditional budgeting concept, however, budgets remain time-consuming and costly.

The second review covers the analysis of the “soft” factors of budgets, which are linked to the effects of budgets on organizations and managers. The weaknesses reported on traditional budgets are shortly reviewed and discussed in the context of AI-based budgeting.

In the past decades, academic literature analyzed the budgeting process from a variety of scientific angles, e.g., economic, psychological, and sociological perspectives (see Shields & Shields, 1998; Fisher et al., 2000; Luft & Schields, 2003; Fisher et al, 2006). These studies often refer to the budgeting process from an experimental-negotiation perspective, emphasizing superior and subordinate interactions and evaluating managers’ reactions to varying levels of budgetary participation. However, there are no homogenous recommendations with respect to the optimal level of individual involvement in the determination of budgets (see Brownell, 1980; Young, 1985; Wagner, 1994; Shields & Shields; Wentzel, 2002; Kyj & Parker, 2008; Hofstede, 2012; Kramer & Hartmann, 2014). Meanwhile, all results claim that budgets affect the relationship of managers with their companies and that budgeting processes send different social signals to managers, whereby relationships and attitudes are influenced.

The recommendation for an AI-based budgeting approach becomes more imbalanced and ambivalent concerning the above-mentioned weaknesses given the high complexity of human behavior. Past studies underline the importance of soft factors in budget setting, therefore it can be highlighted that these factors should not be neglected when moving to an AI-based budgeting approach. With regard to the weaknesses reported by Neely, it can be assumed that budgets based on AI activities will make people feel under-valued due to budget restrictions and fixed targets that may are not aligned with individual expectations. It will be of main importance for organizations to counteract to the above, otherwise, the new budgeting process may not encourage knowledge sharing but increases budget gaming and budgetary slack. A major problem said to cause dysfunctional behavior is the connection of budgets with the reward system (Jensen, 2003, p. 386), e.g. once the budget is achieved, there is less incentive for managers to go beyond it. A new reward system where performance measures are based on AI outputs may not counteract to these problems, in particular, if the budget target is rejected by the management. Therefore, this still represents a barrier to an AI-based budgeting approach.

Conclusion

Concerning the question presented at the beginning of this article, it can be assumed that AI methods will be embedded in the future into existing budgeting approaches. An AI-supported budgeting approach can truly improve allocation processes by accelerating and strategically enhancing budgets through more sophisticated analysis methods, which may offer new insights for decision-makers, however, what is consistent is that budgets likely remain time-consuming and costly.

As a recommendation to organizations, it can be highlighted to not neglect the soft-factors of the budgeting process. Successful budgets are not only linked to cognitive intelligent allocations but also depend on emotional and social intelligent decisions. Real gains in competitive advantage are only achieved by the successful interaction of technologies and people to support the smart use of information. In this context, it is also important to keep in mind that humans are still needed to execute the strategies and bear their reasonability.

In the future, organizations are dared to identify a good process design by looking at best practices and combining different techniques depending on the organizational needs. The budgeting process needs to involve individuals at an acceptable level to make managers feel appreciated and to encourage knowledge sharing. Thereby the full value of motivation and innovative strength can be captured. A combination of various principles and techniques may help to motivate the management, increase accountability in decision making, improve responsiveness in changing market dynamics, reduce budgetary slack-building behavior and finally help to align strategic objectives with business operations. Analogically, the statement that the output depends on the input is also valid for the budgeting process. When a budget is well designed and implemented, good results are achieved in form of good performance and vice versa.

Today, despite the noise around AI and BDA there are less detailed use-cases in corporate finance where AI has changed and improved business processes. The research state can be rather characterized to be in its infancy state. Insights of real-world evidence may further help practitioners and researchers to understand the opportunities and challenges in transforming business models. With reference to the new technological-based environment, further investigation of how new technologies can support budgetary effectiveness and managerial performance will be useful to generate. These studies may also give explanations, how new processes can be embedded into existing structures, and what risks and limitations may arise.

The future budgeting discipline depends also on new perspectives and complementary theories to capture the great complexity of human behavior and organizational success. Insights of new economic, sociological, and psychological studies may further help practitioners to understand success factors of budgeting processes, the relevance of participation in setting budget targets, and the impact of the fast-changing environment.

Appendix

Bibliography

Arel, I., Rose, D. C., & Karnowski, T. P. (2010). Deep machine learning-a new frontier in artificial intelligence research. IEEE computational intelligence magazine, 5(4), 13-18.

Brownell, P. (1980). Participation in the budgeting process: When it works and when it doesn’t.

Bundy, A. (2017). Preparing for the future of Artificial Intelligence.

Bunce, P., Fraser, R., & Woodcock, L. (1995). Advanced budgeting: a journey to advanced management systems. Management accounting research, 6(3), 253-265.

El Misilmani, H. M., & Naous, T. Machine Learning in Antenna Design: An Overview on Machine Learning Concept and Algorithms.

Fisher, J. G., Frederickson, J. R., & Peffer, S. A. (2000). Budgeting: An experimental investigation of the effects of negotiation. The Accounting Review, 75(1), 93-114.

Fisher, J. G., Frederickson, J. R., & Peffer, S. A. (2006). Budget negotiations in multi-period settings. Accounting, Organizations and Society, 31(6), 511-528.

Gartner, (2019). 3 Barriers to Adopting Artificial Intelligence in Financial Planning and Analysis, p. 1-8.

Gandomi, A., & Haider, M. (2015). Beyond the hype: Big data concepts, methods, and analytics. International Journal of Information Management, 35(2), 137-144.

Goode, M., & Malik, A. (2011). Beyond budgeting: the way forward?. Pakistan Journal of Social Sciences (PJSS), 31(2).

Grove, W. M., Zald, D. H., Lebow, B. S., Snitz, B. E., & Nelson, C. (2000). Clinical versus mechanical prediction: a meta-analysis. Psychological assessment, 12(1), 19.

Horvàth, Controlling, 11. Aufl., Verlag Vahlen, München 2009.

Hansen, S. C., Otley, D. T., & Van der Stede, W. A. (2003). Practice developments in budgeting: an overview and research perspective. Journal of management accounting research, 15(1), 95-116.

Hofstede, G. H. (2012). The game of budget control. Koninklijke Van Gorcum & Compo N.V., Assen, The Netherland, 1-7.

Hope, J., & Fraser, R. (2003). Beyond budgeting: how managers can break free from the annual performance trap.

Hope, J., & Fraser, R. (2003). Beyond budgeting. Harvard Business School Press, Boston, 108-115.

Hope, J., & Fraser, R. (2013). the Budget. Budgetierung im Umbruch?, 1, 71.

Jäger, C., & Altrogge, C. (2011). Beyond Budgeting vs. Better Budgeting–eine kritische Analyse zukünftiger Entwicklungen. Schriften zur angewandten Mittelstandsforschung, 3(9), 1-13.

Jensen, M. C. (2003). Paying people to lie: The truth about the budgeting process. European Financial Management, 9(3), 379-406.

Kahneman, D. (2015). Daniel Kahneman:‘What would I eliminate if I had a magic wand? Overconfidence’. Sat, 18, 09-00.

Kaplan, A., & Haenlein, M. (2019). Siri, Siri, in my hand: Who’s the fairest in the land? On the interpretations, illustrations, and implications of artificial intelligence. Business Horizons, 62(1), 15-25.

Laitinen, E. K., Länsiluoto, A., & Salonen, S. (2016). Interactive budgeting, product innovation, and firm performance: empirical evidence from Finnish firms. Journal of Management Control, 27(4), 293-322.

Lehr, D., & Ohm, P. (2017). Playing with the data: what legal scholars should learn about machine learning. UCDL Rev., 51, 653.

Libby, T., & Lindsay, R. M. (2010). Beyond budgeting or budgeting reconsidered? A survey of North-American budgeting practice. Management accounting research, 21(1), 56-75.

Tan, B. S., & Low, K. Y. (2016). Budgeting Practice in Singapore–An Exploratory Study Using a Survey.

Luft, J., & Shields, M. D. (2003). Mapping management accounting: graphics and guidelines for theory-consistent empirical research. Accounting, organizations and society, 28(2-3), 169-249.

McCorduck, P. (2004). Machines Who Think, Natick. MA: AK Peters Ltd.

Morlidge, S., & Player, S. (2010). Future ready: How to master business forecasting.

Neapolitan, R. E., & Jiang, X. (2018). Artificial Intelligence: With an introduction to machine learning. Chapman and Hall/CRC.

Neely, A., Bourne, M., & Adams, C. (2003). Better budgeting or beyond budgeting?. Measuring business excellence, 7(3), 22-28.

Parker, L. D., & Lewis, N. R. (1995). Classical management control in contemporary management and accounting: the persistence of Taylor and Fayol’s world. Accounting, Business & Financial History, 5(2), 211-236.

Parkes, D. C., & Wellman, M. P. (2015). Economic reasoning and artificial intelligence. Science, 349(6245), 267-272.

Pennachin, C., & Goertzel, B. (2007). Contemporary approaches to artificial general intelligence. In Artificial general intelligence (pp. 1-30). Springer, Berlin, Heidelberg.

Player, S. (2003). Why some organizations go “beyond budgeting”. Journal of Corporate Accounting & Finance, 14(3), 3-9.

Popesko, B., Novák, P., Papadaki, S., & Hrabec, D. (2015). ARE THE TRADITIONAL BUDGETS STILL PREVALENT: THE SURVEY OF THE CZECH FIRMS BUDGETING PRACTICES. Transformations in Business & Economics, 14.

Reinke, J., (2016). Rolling forecast und rollierende Planung im Vergleich zur klassischen Jahresplanung (mit detailliertem Jahresend-Forecast) – Gestaltungsmöglichkeiten und Grenzen, in: CM 04/2016, S. 48-54

Sandalgaard, N., & Nikolaj Bukh, P. (2014). Beyond Budgeting and change: a case study. Journal of Accounting & Organizational Change, 10(3), 409-423.

Shields, J. F., & Shields, M. D. (1998). Antecedents of participative budgeting. Accounting, Organizations and Society, 23(1), 49-76.

Wagner III, J. A. (1994). Participation’s effects on performance and satisfaction: A reconsideration of research evidence. Academy of management Review, 19(2), 312-330.

Wallander, J. (1999). Budgeting—an unnecessary evil. Scandinavian journal of Management, 15(4), 405-421.

Wentzel, K. (2002). The influence of fairness perceptions and goal commitment on managers‘ performance in a budget setting. Behavioral research in Accounting, 14(1), 247-271.

Young, S. M. (1985). Participative budgeting: The effects of risk aversion and asymmetric information on budgetary slack. Journal of accounting research, 829-842.

Zeller, T. L., & Metzger, L. M. (2013). Good Bye Traditional Budgeting, Hello Rolling Forecast: Has the Time Come?. American Journal of Business Education, 6(3), 299-310.

Zhongzhi, S. (2019). Advanced artificial intelligence (Vol. 4). World Scientific.

Zyder, M. (2007). Die Gestaltung der Budgetierung: eine empirische Untersuchung in deutschen Unternehmen. Springer-Verlag.

Um einen Kommentar zu hinterlassen müssen sie Autor sein, oder mit Ihrem LinkedIn Account eingeloggt sein.